Taking the financial markets by storm and redefining finance as a whole, Strategy₿’s Bitcoin strategy is a new and complex concept. The intricacies of the strategy require a deep understanding of Bitcoin but also expertise of corporate finance, security analysis and other financial market components. While it is fascinating to see Bitcoin collide with traditional finance, any lack of knowledge in the aforementioned topics has led the strategy to be broadly misunderstood.

“If you don’t have a Bitcoin strategy, you don’t have a strategy.” Michael Saylor

The concept has grown in popularity, leading to the emergence of numerous imitators across various jurisdictions, each adopting its own variation of the playbook. Among the most notable companies following a similar strategy are Metaplanet in Japan, Semler Scientific in the United States, The Blockchain Group in France, and the SmarterWeb Company in the United Kingdom, to name just a few.

In this piece, I use Strategy₿’s early version of its playbook as a case study to provide a clear, high-level overview of its Bitcoin strategy, offering straightforward explanations and addressing some of the most common misconceptions along the way. I also try to anticipate potential risks that could become threats at a later stage of Strategy₿’s journey. In order to achieve this, I answer six fundamental questions:

- Why and how did the Bitcoin strategy emerge?

- What does Strategy₿ actually do?

- How does Strategy₿ create value for its shareholders?

- How is this strategy different from other speculative attacks?

- When does this playbook end?

- What are the risks of this all?

Why and how did the Bitcoin strategy emerge?

In the summer of 2020, Michael Saylor, the co-founder, executive chairman of and back then Chief Executive Officer of Strategy₿, faced a critical dilemma. The company’s treasury held hundreds of millions of dollars in cash, a seemingly prudent buffer during uncertain times. But with interest rates near zero and inflation fears mounting in the wake of pandemic-era monetary expansion, Michael Saylor saw that cash was quietly bleeding value. “Cash is a melting ice cube,” he famously declared and he was not interested in watching Strategy₿’s reserves evaporate. After extensive personal research, he concluded that Bitcoin offered the best hedge against monetary debasement and presented a bold opportunity for corporate capital preservation.

In August 2020, Michael Saylor announced that the company bought $250 million worth of Bitcoin with their treasury. That decision marked the beginning of a radical corporate strategy: converting excess cash into Bitcoin and adopting it as the company’s primary treasury reserve asset. It was, depending on who you ask, a straightforward strategy. Independent of Strategy₿’s software business and its future profits, a simple way of valuing the company would be to take the assets held in its balance sheet. Accordingly, Bitcoin holdings would have been valued one-to-one.

This approximation held more or less true until Strategy₿’s first $500 million bond issuance in June 2021, when the company announced they would buy Bitcoin with the proceeds of the sale. Although he did not realize it at the time, Michael Saylor had stumbled on a paradigm shift, which still holds true today: First, there is a huge demand for Bitcoin-backed fixed income products and other Bitcoin-backed securities. Secondly, Strategy₿ identified a way to acquire more Bitcoin in a manner that is accretive to Strategy₿ shareholders, increasing their Bitcoin holdings per share.

What does Strategy₿ actually do?

Currently many institutions cannot or do not want to hold Bitcoin directly for different reasons (such as company charters not allowing it, or Bitcoin’s volatility). However, these market participants are very keen to have some exposure to Bitcoin by different means and the appetite for Bitcoin-backed securities is tremendous. This is where Strategy₿ comes in.

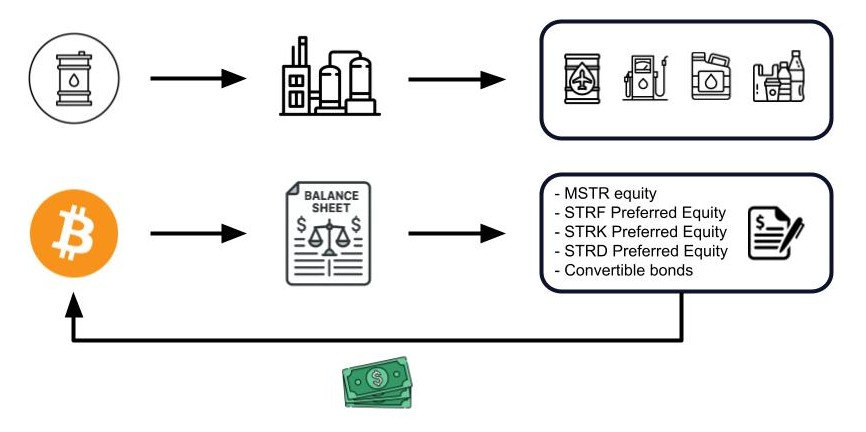

Through financial engineering and Strategy₿’s treasury operations, Michael Saylor is straddling Bitcoin to traditional finance (Tradfi) by embedding Bitcoin into the various types of securities he is selling. This process can be compared to financial institutions designing and creating a structured product based on any underlying asset imaginable. Precisely this process is what Michael Saylor alludes to, when he compares Strategy₿ to an oil refining company. Extending the analogy further, Figure 1 illustrates how oil represents Bitcoin, the refinery corresponds to the balance sheet, and the refined oil products (such as jet fuel, diesel, kerosene…) symbolize the various securities sold by Strategy₿.

Figure 1: Strategy₿’s “refining” of Bitcoin into securities

How does Strategy₿ create shareholders value?

As shareholders understood the dynamics at play, they expected that Strategy₿ would hold more Bitcoin in the future for the same amount of shares by leveraging the balance sheet to acquire Bitcoin. This expectation birthed the crux of the matter, the discussion about the multiple of the Net Asset Value (or mNAV) premium on the Bitcoin held by the company. The valuation method based on the mNAV could be paralleled to the forward expectation of future cash-flows valuation, such as discounted cash-flows (or DCF), applied by analysts to value equities. In other words, the mNAV premium would be the equivalent to the expectation of the future Bitcoin holdings by the company. However, it is worth mentioning that the mNAV valuation is based on a balance sheet item, whereas traditional valuation methods are based mostly on the Profit and Loss Statement (P&L).

Defining the mNAV

Strategy₿ holds a certain amount of Bitcoin on its balance sheet. Multiplying this Bitcoin count with the Bitcoin price gets the Bitcoin Net Asset Value (or Bitcoin NAV). Basically, the Bitcoin NAV represents the market value of the Bitcoin held by Strategy₿.

Bitcoin NAV = Bitcoin Count x Bitcoin Price

The mNAV is equivalent to the multiple of the Bitcoin NAV, which is simply the Enterprise Value (or EV) divided by the Bitcoin NAV. The EV is a measure of a company’s total value, it reflects the total cost to acquire a business. Thus the EV is equal to the sum of the company’s current market capitalization, total debt, and total preferred stock, minus their most recently reported cash balance. The mNAV can therefore be calculated as follows:

mNAV = EV / Bitcoin NAV

In other words, the mNAV provides Strategy₿’s valuation, potentially with a premium or discount, on its Bitcoin held. If the mNAV is above 1, Strategy₿ trades at a premium, and if the mNAV is below 1, the company trades at a discount.

Say Strategy₿ has:

- a total market capitalization of $15’000

- a total debt of $3’500

- a total preferred stock of $2’000

- a total cash balance of $500

So the EV = 15’000 + 3’500 + 2’000 – 500 = $20’000

Strategy₿ holds 0.1 Bitcoin

Bitcoin trades at a price of $100’000

So Bitcoin NAV = 0.1 x 100’000 = $10’000

And mNAV = 20’000 / 10’000 = 2

Strategy₿ therefore trades at an mNAV of 2.

Example 1: Calculating Strategy₿’s mNAV

Creating shareholder value via share premium

Having a (mNAV) premium on the shares, allows Michael Saylor to run his playbook. Firstly, due to Bitcoin’s monetary policy (a predictable, controlled ever decreasing rate of inflation), expectations are that Bitcoin will increase its value in fiat terms. If Bitcoin price increases, Strategy₿’s stock price would increase too, strengthening the balance sheet as the leverage ratio to equity decreases. In turn allowing the company to leverage up again to buy more Bitcoin, further increasing the mNAV premium on the shares. While the mNAV premium remains high, Strategy₿ can issue more shares and sell them to capture this spread to provide more Bitcoin per share and create value for its shareholders, as explained in Example 2.

Say Strategy₿ (ticker: MSTR) has 10 shares outstanding

1 MSTR share is currently trading at $500

So the total market capitalization of MSTR equals to $5’000

Bitcoin (BTC) is trading at $100’000 per coin

Each MSTR share corresponds to $100 of BTC on their balance sheet

Strategy₿ has a total of $1’000 BTC on its balance sheet (or 0.01 BTC)

BTC/share = 0.01 BTC/10 shares = 0.001 BTC per share

Say that MSTR is trading at 5x its underlying BTC holdings (or mNAV = 5)

If Strategy₿ were to issue another 10 MSTR shares at the current price of $500 each,

then it takes $5’000 from the sale of the shares and buys $5’000 worth of BTC.

Now there are 20 total shares outstanding

Total BTC held by Strategy₿ = $1’000 + $5’000 = 0.06 BTC

So BTC/share = 0.06 BTC/20 shares = 0.003 BTC per share

Strategy₿ tripled the amount of BTC for each share.

Example 2: Explaining how Strategy₿’s share issuance and selling scheme is accretive (and not dilutive) to shareholders as long as there is a premium (mNAV remains above 1)

Creating shareholder value via convertible bonds

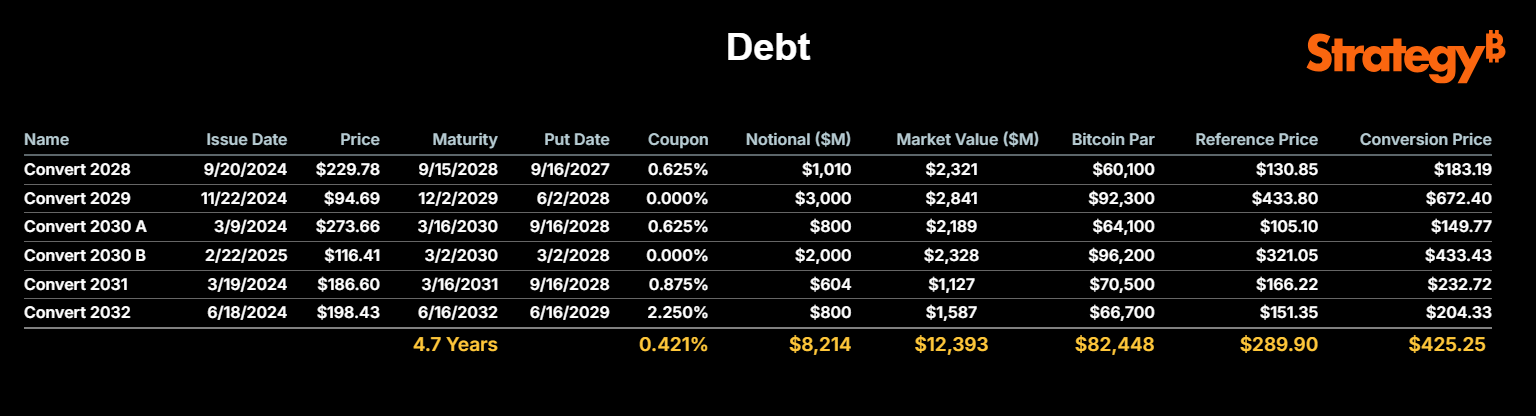

Taking a closer look at Strategy₿’s leverage, the company’s favorite means of financing initially was through convertible senior notes, commonly referred to as “convertible bonds”. A convertible bond gives the right to the holder to convert the bond into shares at a certain conversion price or receive back the principal amount at the maturity date. In a way, holders of these convertible bonds are given an insurance policy to the downside, should the share not perform. This additional insurance policy comes at a price, allowing Strategy₿ to set extremely low interest rates on these instruments (see Figure 2). (Note: Since then, Strategy₿ has evolved its playbook, shifting from convertible bonds to preferred shares. However, we will not further delve into the details of this new strategy here.)

Figure 2: Strategy₿’s debt structure as of 10th July 2025 (source: https://www.strategy.com/debt)

Two scenarios are now possible: (1) If the price of the share rallies above the conversion price, it is financially attractive for the bond holder to convert the bond into shares. The debt turns into equity on the balance sheet and Strategy₿ does not have to pay that principal amount back. Alternatively, (2) if the price of the share underperforms and remains below the conversion price at the maturity date, the bond holder will not convert and Strategy₿ will have to repay the principal amount. In both cases, as long as Bitcoin increases in value, the convertible bonds are accretive to shareholders.

Initial situation - convertible bond issuance and sale

Say Strategy₿ has 10 shares outstanding

1 MSTR share is currently trading at $500

So the total market capitalization of MSTR equals to $5’000

BTC is trading at $100’000 per coin

Each MSTR share corresponds to $100 of BTC on their balance sheet

Strategy₿ has a total of $1’000 BTC on its balance sheet (or 0.01 BTC)

BTC/share = 0.01 BTC/10 shares = **0.001 BTC per share**

So MSTR is trading at 5x its underlying BTC holdings (or mNAV = 5)

If Strategy₿ were to issue 1 convertible bond for $5’000,

convertible into 5 shares (conversion price = $1’000) and a maturity date in 2027.

Strategy₿ takes $5’000 from the sale of the bond and buys $5’000 worth of BTC.

There are currently still 10 shares outstanding

Total BTC held by MSTR = $1’000 + $5’000 = 0.06 BTC

So BTC/share = 0.06 BTC/10 shares = **0.006 BTC per share**

Based on this initial situation, three scenarios for when the convertibale bond is due deserve closer consideration.

-

Scenario 1: MSTR is above conversion price and BTC price performs positively.

Although at the maturity date, the amount of BTC per share decreased in comparison to the BTC at the date of the acquisition, Strategy₿ managed to quadruple the amount of BTC for each share compared to the initial position. -

Scenario 2: MSTR is below conversion price but BTC price performs positively.

In this scenario, Strategy₿ still managed to accumulate more BTC per share although the MSTR share price did not perform as well as expected and the loan had to be repaid. -

Scenario 3: MSTR is below conversion price and BTC price performs negatively.

In this last scenario, Strategy₿ failed to accumulate more BTC per share as neither the BTC price nor the MSTR price performed and the loan had to be repaid.

| Metric | Scenario 1: accretion | Scenario 2: accretion | Scenario 3: dilution |

|---|---|---|---|

BTC price | $300’000 | $180’000 | $90’000 |

Initial shares outstanding | 10 | 10 | 10 |

MSTR price | $1’500 | $900 | $250 |

MSTR market cap | $15’000 | $9’000 | $2’500 |

MSTR holdings (BTC) | 0.06 | 0.06 | 5 |

Bond holder converts | 5 new shares | 0 new shares | 0 new shares |

Final shares outstanding | 15 shares | 10 shares | 10 shares |

Sale of BTC | Not needed | 5’000 / 180’000<br/>= 0.02778 BTC | 5’000 / 90’000<br/>= 0.0556 BTC |

BTC per share | 0.06 / 15<br/>= 0.004 BPS | (0.06-0.02778) / 10<br/>= 0.003222 BPS | (0.06 – 0.0555) / 10<br/>= 0.0004 BPS |

Example 3: Three scenarios illustrating accretion (1, 2) or dilution (3) from convertible bond issuance, based on Bitcoin and share price performance at maturity.

To sum up, by leveraging up its balance sheet and selling equity, Strategy₿ is creating value to its shareholders by adding more Bitcoin per share (BPS), what Michael Saylor started referring to as “Bitcoin yield”.

How is this strategy different from other speculative attacks?

On October 30, 2024, during Strategy₿’s third quarter earnings call, the company announced its “21/21 Plan”. Its premise is to buy $42 billion worth of Bitcoin, $21 billion through equity and $21 billion through fixed income, over the next three years. The announcement also came with the new at-the-market (ATM) equity offering program, allowing Strategy₿ to issue and sell shares up to an aggregate offering price of $21 billion. In the meantime, Strategy₿ has completed the issuance of $21 billion in equity and, including the debt component, has achieved approximately 65% of its “21/21 Plan”. Consequently, on May 1, 2025, Strategy₿ announced it would double the scope of the plan, rebranding it as the “42/42 Plan”, with the goal of acquiring $84 billion worth of Bitcoin.

Since the first announcement, Strategy₿ has been buying Bitcoin at a staggering rate. The buying frenzy has brought many discussions. Amongst the more prominent is the concern that shareholders are being diluted when the company issues and sells more shares, which is clarified in Example 2. Another outstanding concern is that Michael Saylor is cornering the Bitcoin market, in a similar fashion as the Hunt Brothers cornered the silver market in the 80’s.

In early 1980, billionaires Nelson Bunker Hunt, William Herbert Hunt and Lamar Hunt (known as the “Hunt Brothers”) started buying, accumulating silver at a tremendous speed, up to a third of the silver not owned by governments and consequently pushing the price much higher. Silver is a commodity found in the earth’s crust in abundance and if prices are pushed up, miners will mine more as long as it remains profitable, flooding the market with fresh supply of newly mined silver. Hence, silver prices will start to decrease until there is a stabilization between supply and demand. The artificial demand created and price increase by the Hunt Brothers was short lived.

Bitcoin, unlike silver, cannot be mined on demand. Every two weeks, the difficulty adjustment ensures that if more mining power is put into the protocol, Bitcoin mining becomes more difficult, keeping the mining schedule at a constant of a block every 10 minutes (on average). Ultimately, the supply of Bitcoin remains constant and cannot be changed. Unlike the silver miners, the Bitcoin miners cannot flood the market with new Bitcoin.

Michael Saylor, with his aggressive buying of Bitcoin, is indeed cornering the Bitcoin market. Bitcoin supply is not keeping up with his demand. However, as Bitcoin’s supply cannot be increased at will, Michael Saylor should not succumb to the same fate as the Hunt Brothers.

When does this playbook end?

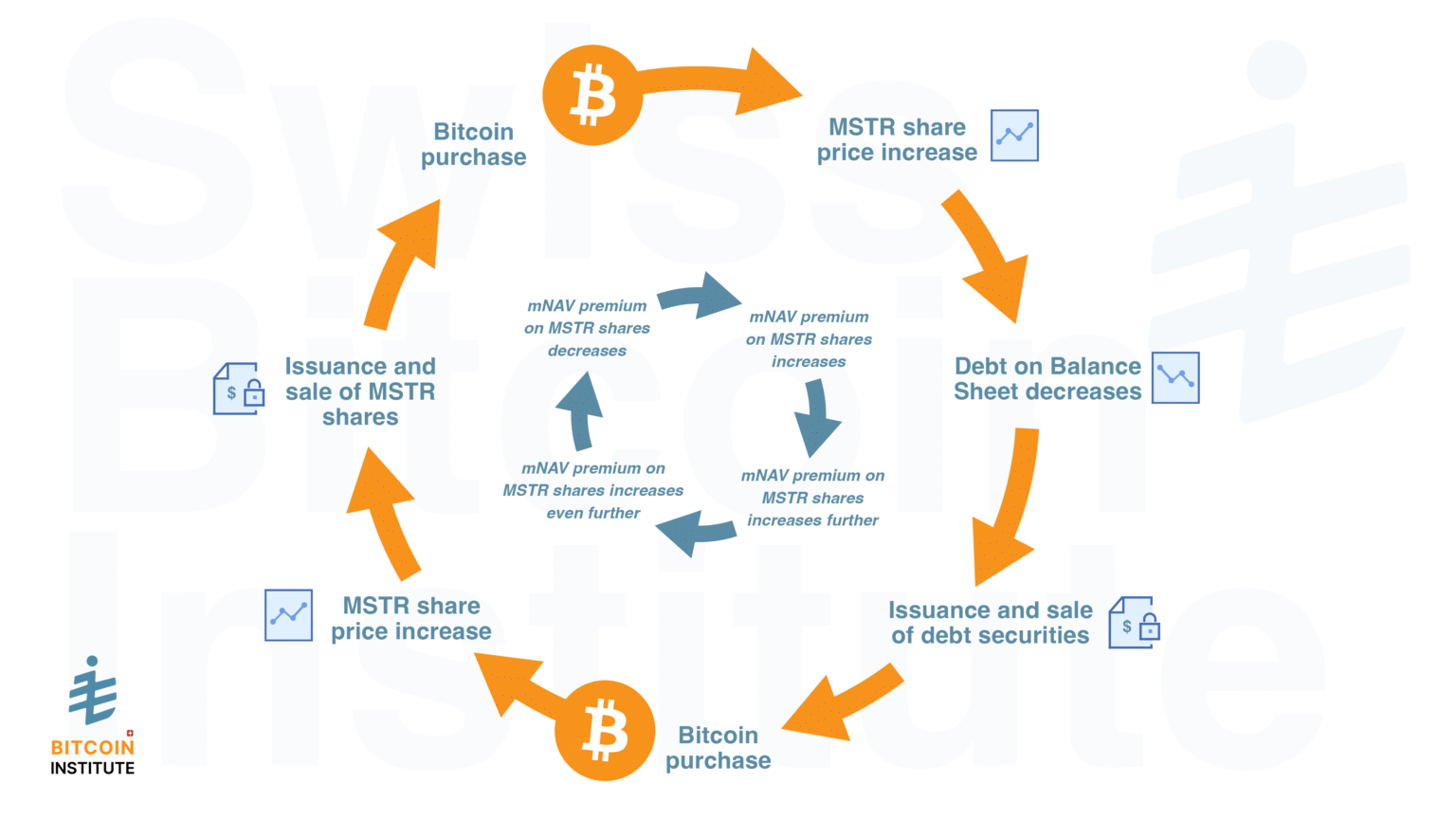

As already mentioned previously, if Bitcoin’s price rises, so should Strategy₿ shares. As the equity increases, the balance sheet becomes healthier and allows the company to raise leverage again to buy more Bitcoin, boosting the mNAV premium on the shares. With the mNAV premium high, Strategy₿ can issue shares and sell them to capture this difference and acquire even more Bitcoin. The buying spree increases Bitcoin’s price increasing the share price again and this becomes a feedback loop with no end in sight, which is presented in Figure 3. Strategy₿ can rinse and repeat this process many times over. Some have referred to it as the “infinite money glitch”.

Figure 3: Strategy₿’s so-called “Infinite Money Glitch”

The future is yet to be told, therefore, we can only speculate as to how this “glitch” ends or at least wanes. Strategy₿ pivoted to this new strategy not too long ago and it is hard to estimate the demand for Bitcoin-backed securities. Although Strategy₿ is currently like a black hole sucking liquidity from the equity and bonds markets through the constant issuance of securities at an astounding rate, the limitations will most likely come from the decrease or lack of demand for these Bitcoin-backed securities.

Assuming that fiat remains the main currency for global trade and exchange, and as Strategy₿ and other companies with the same playbook (such as Metaplanet in Japan) flood the markets with enough securities to satisfy the demand, the liquidity should dry out, at least for a period of time. Likely the demand will be cyclical based on events (such as the Bitcoin halving) and other economic factors or events.

Interestingly, as these cycles play out, the amount of Bitcoin that Strategy₿ can buy will also decrease mostly because of Bitcoin’s scarcity but probably also of Bitcoin’s increase in price. If this happens, all else equal and assuming that Strategy₿ has not found a new way to increase its Bitcoin holdings via a new business model (such as a Bitcoin bank), the mNAV should converge back close to 1 in the long run.

What are the risks?

Bitcoin valuation risk

The risk that seems quite obvious is Bitcoin’s price decreasing or remaining flat over the next few (three or more) years. Should this happen, Strategy₿ could enter into trouble to repay the principal on the convertible bonds with maturity dates in 2027 and beyond. The outcome of such a risk is presented in Example 3 – scenario 3 above, where shareholders wind up with less Bitcoin per share. In general, any prolonged decline in Bitcoin prices undermines Strategy₿’s goals.

Antitrust regulatory risk

Strategy₿ is growing at an unfathomable rate. Eventually, it would not be inconceivable to see the company become the biggest market capitalization in the world. Regardless of whether that becomes true, a few risks could materialize, particularly if Strategy₿ keeps its current dominance with a quasi-monopoly stance on Bitcoin-backed securities. Although, with the recent surge of publicly traded companies starting to copy Michael Saylor’s playbook, Strategy₿ may be facing quite some competition.

Michael Saylor likes to compare Strategy₿ to Standard Oil, the company that made John D. Rockefeller the richest man in the world during the gilded age. Considering the fate of Standard Oil, it seems ominous to do so. Part of Standard Oil’s gargantuan reach was that it bought its competitors and companies down the value chain necessary to produce the refined oil products. However, it grew to such levels that it caught the eye of the government and eventually Standard Oil was forced to be split into pieces by antitrust laws set by the government. The risk implied is whether the government could subject Strategy₿ to a similar fate by setting similar laws?

Government asset appropriation risk

There is another risk stemming from government overreach. Similarly to executive order 6102, when President Franklin D. Roosevelt confiscated the Gold of the U.S. Citizens in 1933, the U.S. government could overtake the Bitcoin in Strategy₿’s balance sheet as its own. It is important to note that this risk increases as the company accumulates more Bitcoin, potentially challenging the government’s ability to counter Strategy₿’s growing dominance. This concern becomes even more relevant now that Strategy₿ is directly competing with the government in the issuance of fixed income securities.

Systemic risk

It remains to be seen, but Strategy₿’s dominance (quasi-monopoly and first mover advantage) in the market suggests that it will provide most of the Bitcoin-backed products and would get more tangled with various other big institutions in the financial markets. Reaching a certain threshold, the company may grow big enough to become a systemic risk. In this case, Strategy₿ imploding for any reason could take down the entire financial system.

Even though some of the risks mentioned may seem farfetched, similar events have happened in the past. Mark Twain was on to something when he said: “History doesn’t repeat itself but often rhymes”. Reflecting on the past provides crucial perspective as we venture into uncharted territory.

Final thoughts

Strategy₿ has developed a financial strategy to generate “Bitcoin yield” by increasing Bitcoin per share through a cyclical approach. The company alternates between issuing and selling shares and leveraging its balance sheet — taking on debt mainly via preferred share and convertible bond offerings — to acquire Bitcoin. Essentially, Strategy₿ is arbitraging the current broken financial system with its cheap money and refining it into a pristine asset, Bitcoin. Thereby Michael Saylor placed Strategy₿ on a Bitcoin Standard while simultaneously introducing Bitcoin to the capital markets — revolutionizing them in the process. However, it is worth remembering that we are still at the very early stages of this new paradigm shift and the road ahead will surely be as volatile as Strategy₿’s price.

References

- John Roberts, Jeff. “Software firm MicroStrategy makes a massive bet on Bitcoin with a $250 million purchase.” Fortune, August 11, 2020. Accessed January 22, 2025. https://fortune.com/2020/08/11/buying-bitcoin-MicroStrategy-cryptocurrenc/

- MicroStrategy. “MicroStrategy Acquires Additional Bitcoins and Now Holds Over 105,000 Bitcoins in Total.” June 21, 2021. Accessed January 22, 2025. https://www.MicroStrategy.com/press/MicroStrategy-acquires-additional-bitcoins-and-now-holds-over-105000-bitcoins-in-total_06-21-2021

- MicroStrategy. “MicroStrategy Announces Third Quarter 2024 Financial Results and Announces $42 Billion Capital Plan.” October 30, 2024. Accessed January 22, 2025. https://www.MicroStrategy.com/press/MicroStrategy-announces-third-quarter-2024-financial-results-and-announces-42-billion-capital-plan_10-30-2024

- Strategy.”Strategy Announces First Quarter 2025 Financial Results.” May 1, 2025. Accessed July 24, 2025. https://www.strategy.com/press/strategy-announces-first-quarter-2025-financial-results_05-01-2025

- Walton, Jeff, and Pysh, Preston. “BTC217: MicroStrategy 2025 w/ Jeff Walton.” January 15, 2025. Accessed January 22, 2025. https://www.theinvestorspodcast.com/bitcoin-fundamentals/MicroStrategy-2025-w-jeff-walton

- Kratter, Matthew. “MicroStrategy Deep Dive (Part 2).” Bitcoin University, November 26, 2024. Accessed January 22, 2025. https://www.youtube.com/watch?v=CPwHBspFtZk&t=2s

- MicroStrategy. “MicroStrategy Announces Proposed Private Offering of $700 Million of Convertible Senior Notes.” September 16, 2024. Accessed January 25, 2025. https://www.MicroStrategy.com/press/MicroStrategy-announces-proposed-private-offering-of-700m-of-convertible-senior-notes_09-16-2024

- MicroStrategy. “MicroStrategy Announces Third Quarter 2024 Financial Results and Announces $42 Billion Capital Plan.” October 30, 2024. Accessed January 22, 2025. https://www.MicroStrategy.com/press/MicroStrategy-announces-third-quarter-2024-financial-results-and-announces-42-billion-capital-plan_10-30-2024

- Rudolph, Barbara. “Big Bill for a Bullion Binge.” August 29, 1988. Accessed January 22, 2025. https://time.com/archive/6713106/big-bill-for-a-bullion-binge/

- Nakamoto, Satoshi. “Bitcoin: A Peer-to-Peer Electronic Cash System.” October 31, 2008. Accessed January 22, 2025. https://bitcoin.org/bitcoin.pdf

- Bastardo, Javier. “This Japanese Company Is Playing The Michael Saylor’s Bitcoin Strategy.” Forbes, October 29, 2024. Accessed January 22, 2025. https://www.forbes.com/sites/digital-assets/2024/10/29/this-japanese-company-is-playing-the-michael-saylors-bitcoin-strategy/

- Woo, Willy, and Byworth, Richard. “Ep.7: Willy Woo – Money in the Next 10,000 Years: Kardashev and Beyond.” Syz the Future, December 16, 2024. Accessed January 22, 2025. https://podcast.syzcapital.com/

- Chanos, Jim, Rochard, Pierre and Pysh, Preston. “BTC243: Jim Chanos Vs Pierre Rochard MSTR mNAV debate” Accessed July 24 , 2025. https://www.theinvestorspodcast.com/bitcoin-fundamentals/jim-chanos-vs-pierre-rochard-mstr-mnav-debate/